For strategists interested in planning tools used in the field of brand and communication strategy. It's about practical planning techniques and the concepts that guide a brand strategist's thinking.

What do percentages tell us?

Oh dear, this one is so hard to talk about. There's so much to say and so little fun to talk about it. Boring it is. But not to me. And maybe someone else cares. So let me pick one aspect that especially drives me mad.

Oh dear, this one is so hard to talk about. There's so much to say and so little fun to talk about it. Boring it is. But not to me. And maybe someone else cares. So let me pick one aspect that especially drives me mad.

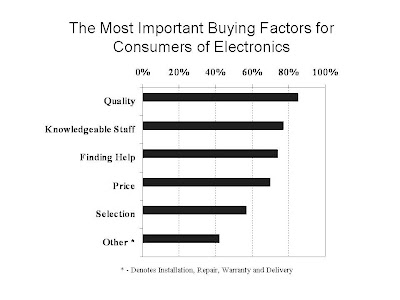

What really puzzles me is the interpretation of the typical bar chart that is supposed to help understand consumers' motives. They go somewhat like this:

Consumers get asked what is "important to them, when it comes to XYZ". Let's leave aside that this is a very naive question. What I want to talk about is just the numbers and what those quantities tell us.

Consumers get asked what is "important to them, when it comes to XYZ". Let's leave aside that this is a very naive question. What I want to talk about is just the numbers and what those quantities tell us.

What happens almost all the time is that we go: "Quality is most important, "Knowledgeable Stuff is second", "Selection seems to be least important." Right? Again, forget about the stupid variables, just go by the numbers. Quality is more important than Selection, right?

Well I don't get that. How can those bars tell this kind of story? The questionnaire obviously must have worked this way: "Tel us how important the following blabla are ... etc" and then each variable could be rated (not ranked, unfortunately!). Now, 80% of the respondents said Yes, or have chosen the Top-2-Boxes when it came to the Quality factor and 50% did that when it came to the Selection factor. But how do we know that for each person, or even for most of the them that the Quality factor is more important than the Selection factor? We have never asked them! What we have measured is not the relative importance but the distribution of high importance of each factor in the population. This tells us that salience of Quality is more frequently found, not that it is literally "higher" than that of Selection.

You see, we just do not know by looking at those bars how many percent of the 80% "Quality Seekers" also find Selection very important. There might be up to 50 percent points of them among those Quality Seekers. So probably most of the people who find Quality important would find Selection just as important. Both factors are rather equally important to most of the respondents! How can we than say that Quality was more important, then?

What could it probably mean "Quality is more important?". What they mean is: if you improve your quality perception this would appeal to more people than when you improve your perceived selection. So the underlying assumption behind that kind of bar chart is: "The more people you target the more successful you will be." Thus, the primary imperative is Reach. You can easily evaluate if your task at hand is in-line with this imperative. If it is - than there's nothing wrong about those bars and their interpretation.

Let me give you three examples:

Task 1) "Differentiate our brand from the competitors in the industry."

Task 2) "Create more loyalty for our brand. Raise the re-purchase rate."

Task 3) "Position our new product as the first of its kind and leverage first-mover advantages fully."

Which of these tasks is the one that is in-line with the assumption "The more people you target the more successful you will be"? Give it a try!

---------------------------------------------------------------

----------------------------------------------------------------

---------------------------------------------------------------

----------------------------------------------------------------

Obviously, it's Task 3. Being the first mover means grasping and owning the most popular, most obvious factors. Task 2 is not primarily about reach because it is rather about depth. Task 1 is not primarily about reach because it's rather about partitioning. Of course, in the sub-segments you are sort of aiming for reach, you could argue. But even that doesn't always have to be true: loyalty could very much be about individual, not popular priorities. Differentiation could is probably more focused on less popular yet energetic, unoccupied territories to make them popular. E.g. Axe/Lynx occupied "smell" probably not because it is the most "important" factor in terms of it's statistical distribution in the total population. But it makes a stronger brand positioning than going for "antiperspirant effect" which probably is slightly more frequently rated as "important".

The most important bias at work when looking at those percentage bar diagrams is a visual one. We are automatically attracted to the longer bar. To us it seems more potent, thus more effective etc.

And we all make use of this bias. Especially because planners often rather abuse than use data. They abuse them "to make the point" = to soothe clients' worries = to make them think less.

Instead of making us think more data - especially simple descriptive percentages - make us think less. That's a pity. We should think much more about what data tell us. Not exactly because this would always make us read more out of the data. In the stupid case above - the very first pic I found on the Net - there's not much to be read. It's not very useful. All planners know that. But we should think more about data e.g. in order to learn how to design better surveys. I would start with the question: "How can we measure how important one thing is compared to another?" and "What needs to be known before we can measure that?". But maybe we just can't know what's important?

And we all make use of this bias. Especially because planners often rather abuse than use data. They abuse them "to make the point" = to soothe clients' worries = to make them think less.

Instead of making us think more data - especially simple descriptive percentages - make us think less. That's a pity. We should think much more about what data tell us. Not exactly because this would always make us read more out of the data. In the stupid case above - the very first pic I found on the Net - there's not much to be read. It's not very useful. All planners know that. But we should think more about data e.g. in order to learn how to design better surveys. I would start with the question: "How can we measure how important one thing is compared to another?" and "What needs to be known before we can measure that?". But maybe we just can't know what's important?

A very entertaining but sound talk on how content vs. advertising works

|

| David Ogilvy’s Oysters Ad |

Down below you will find a really a wonderful talk given by Paul Feldwick on several very interesting topics.

Among others you can hear and learn about:

- an anecdote about David Ogilvy’s first ad idea (the oysters ad)

- a taxonomy of advertising effectiveness models

- a definition what content really is

- a discussion why content is NOT the opposite of advertising

- and some more.

I really recommend to watch it. Enjoy!

Subscribe to:

Posts (Atom)